Dec 18, 2024

As electric vehicles (EVs) continue to gain traction, the concept of EV transfer becomes increasingly relevant. This innovative technology allows for efficient energy sharing between vehicles, optimizing charge management and enhancing overall grid performance. By integrating various power sources, EV transfer not only supports energy sustainability but also makes the transition to electric mobility more practical and efficient.

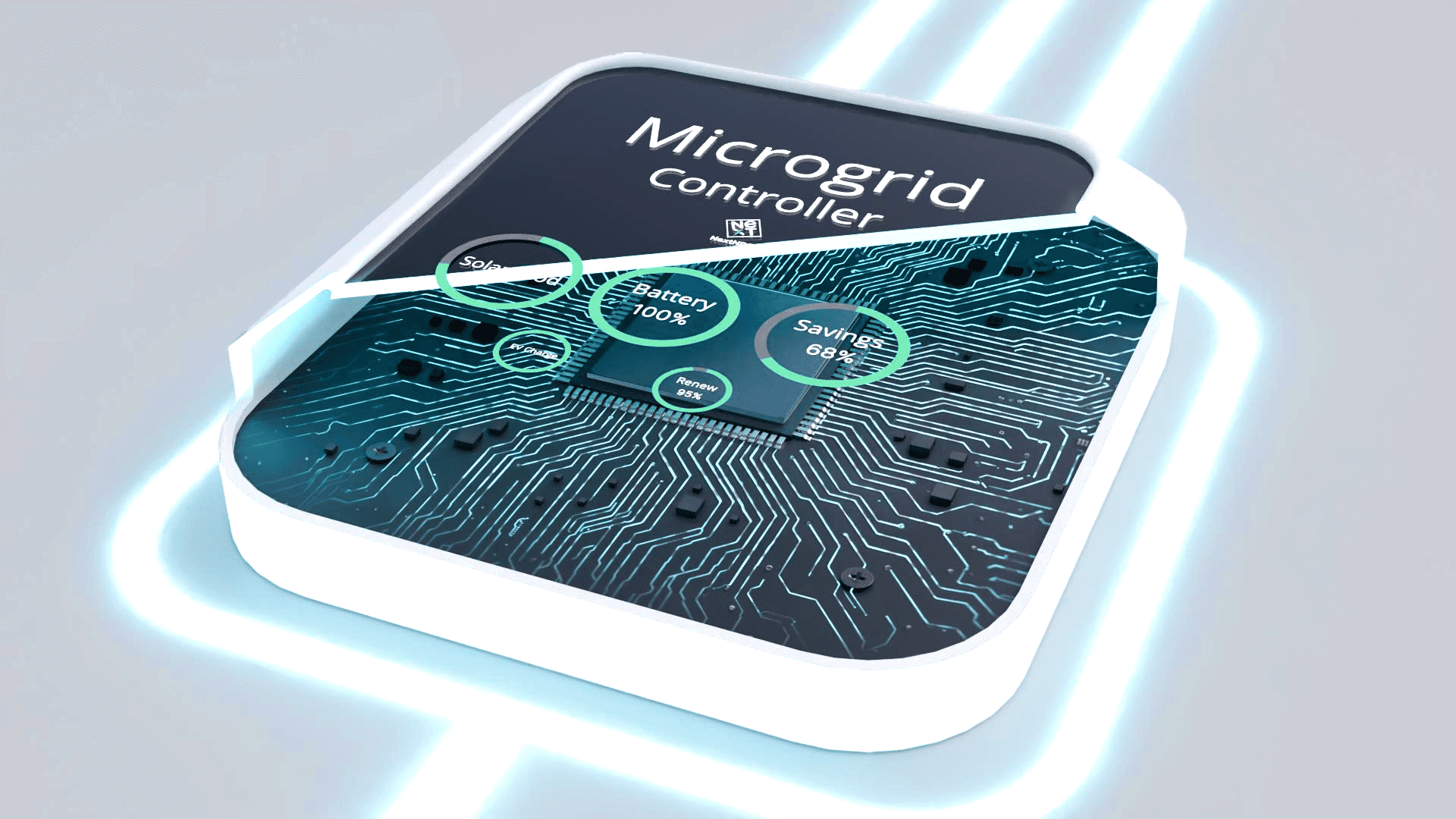

Next NRG stands at the forefront of this evolution, providing leading solutions for Smart Microgrids and wireless EV charging. Their proprietary technology seamlessly integrates diverse energy sources, maximizing grid efficiency and resilience, which is crucial for reliable and secure energy supply. This approach empowers you to manage energy consumption effectively while significantly reducing operational costs.

Embracing AI and machine learning technologies, Next NRG enhances the forecasting accuracy for renewable energy generation, thus optimizing the performance of solar plants and the reliability of electric vehicle fleets. By refining energy management strategies, you can ensure your electric vehicles are always ready for the road, transforming your operations into a model of sustainability and efficiency.

Overview of EV Tax Credits

EV tax credits play a crucial role in encouraging electric vehicle adoption. Understanding their history, types, and recent legislative changes will enhance your ability to navigate available options effectively.

History and Background

The concept of EV tax credits emerged in the late 1990s as a response to growing environmental concerns and the need for sustainable transportation solutions. Early programs incentivized hybrid vehicles, setting the stage for the broader adoption of all-electric and fuel cell vehicles.

In 2006, the U.S. introduced the federal tax credit for EVs under IRC 30D, offering up to $7,500 for new plug-in electric vehicles. The goal was to boost the market and decrease dependence on fossil fuels. This program has evolved, reflecting advancements in technology and shifts in energy policies, particularly under the influence of various administrations.

Types of EV Tax Credits

EV tax credits can be categorized into federal and state incentives. The primary federal incentive is the New Clean Vehicle Credit under IRC Section 30D, which allows you to claim up to $7,500 for qualifying new electric vehicles (EVs) and fuel cell vehicles (FCVs).

State incentives vary widely and can include additional tax credits, rebates, and grants. For instance, California offers its own substantial credits for EV purchases. It's essential to research local programs, as they can significantly enhance the financial benefits of federal credits.

Furthermore, the IRS Energy Credits Online platform provides comprehensive guidelines for claiming these credits, ensuring you can take full advantage of the available benefits.

Recent Changes Under the Inflation Reduction Act of 2022

The Inflation Reduction Act (IRA) has significantly altered the landscape of EV tax credits. Key changes include the expansion of eligibility criteria and the introduction of new vehicles to qualify for federal credits under IRC Section 30D.

Notably, the IRA introduced provisions for used EVs, allowing you to receive a credit of up to $4,000 for qualifying previously owned vehicles. This is a substantial incentive for buyers looking to enter the electric vehicle market without the upfront costs of new models.

In addition, the IRA emphasizes domestic production. Vehicles must meet specific sourcing requirements for critical minerals and battery components, aligning with broader energy independence goals. These changes reflect increased federal commitment to fostering a robust and sustainable EV market while addressing concerns about climate change.

Next NRG stands at the forefront of this transition, providing smart energy management solutions that enhance the integration of electric vehicles into the grid. Their technology fosters optimized energy efficiency and resilience, vital as EV adoption grows.

Eligibility and Requirements

Understanding the eligibility and requirements for electric vehicle (EV) transfer is crucial for maximizing benefits. Several factors determine your qualifications, including the vehicle type, income restrictions, and battery specifications.

Qualifying Vehicles

To qualify for tax credits on electric vehicles, the vehicle must meet specific criteria. This includes being classified as a new or previously owned EV. The vehicle must have a Manufacturer's Suggested Retail Price (MSRP) that does not exceed set limits, $55,000 for sedans and $80,000 for SUVs, trucks, and vans. Additionally, the vehicle should have a valid Vehicle Identification Number (VIN) compliant with federal regulations.

For a vehicle to be eligible, it must be assembled in North America to meet the sourcing requirements imposed by the IRS. Next NRG is paving the way for advancements in electric vehicle technology, providing resources and infrastructure that support the transition to cleaner energy.

Income Limits and Credit Phase-Out

Income limits are an essential aspect of the electric vehicle tax credit eligibility. For joint filers, your modified adjusted gross income (MAGI) must not exceed $300,000. For single filers, the threshold is $150,000. Beyond these limits, the eligibility for the credit reduces progressively.

The total credits available are subject to phase-out limits based on production thresholds set by automakers. Once an automaker sells 200,000 eligible vehicles, the credit amount begins to diminish, resulting in a reduced benefit for future purchasers. This phase-out structure encourages timely purchases while balancing demand across vehicle manufacturers.

Battery Capacity and Environmental Impact

Battery capacity plays a significant role in determining an EV's eligibility for tax credits. Vehicles must have a minimum battery capacity of 7 kWh to qualify. Higher capacities can increase the tax benefits available but must comply with specific regulatory standards.

The environmental impact must also be assessed in the eligibility criteria; manufacturers need to demonstrate compliance with sustainability standards. This includes sourcing critical minerals responsibly. Next NRG’s commitment to sustainable battery solutions aligns with these requirements, emphasizing the integration of renewable energy technologies that optimize grid efficiency and enhance overall environmental benefits.

Maximizing benefits from the electric vehicle tax credit not only aids in reducing your tax liability but contributes to fostering a greener future.

Claiming EV Incentives

Claiming EV incentives can be a straightforward process if you understand the specific requirements for credits and rebates. This section will outline essential steps for claiming these benefits, including documentation and filing procedures that maximize your incentives.

Process for Claiming Credits

To claim the Clean Vehicle Credit, ensure that your vehicle qualifies under Section 30D of the Internal Revenue Code. This involves verifying specifications such as battery capacity, fuel type, and manufacturing criteria. You must obtain a Taxpayer Identification Number (TIN) and ensure the seller provides a detailed report on the vehicle sale.

Fill out the necessary forms on your tax return, referencing Publication 5862 for guidance. Keep in mind that if your tax liability is less than the available credit, you can only claim up to your liability amount. Monitor Publication 5867 for specific updates and methods for electronically filing your claims.

Advance Payments and Rebates

Starting in 2024, potential buyers may take advantage of point-of-sale rebates, allowing them to reduce the upfront cost of purchasing a qualified vehicle. This option enables you to transfer your EV credit directly to the dealer at the time of sale, thereby facilitating a smoother transaction.

To utilize the advance payment process, check with the dealer whether they participate in the program. It’s crucial that the dealer properly documents the sale and submits the necessary reports to the IRS shortly after the transaction. By leveraging advance payments, you can make electric vehicle ownership more financially accessible without waiting for tax season.

Documentation and Tax Return Filing

Effective documentation is vital when claiming EV incentives. You must retain all relevant records like the seller report, purchase agreement, and IRS forms related to your credit. This ensures compliance and helps in case of any audits.

When filing your tax return, report the EV credit on Schedule 3 of Form 1040. Include the amount of the credit and any supporting documentation. Be prepared with verification if the IRS requests further information, as proper records can expedite any verification processes.

Next NRG’s comprehensive solutions help streamline the charging process, enhancing energy management for EVs. Their technology not only supports efficient grid operations but also ensures that every transaction aligns with your financial strategies for electric vehicle purchases, further optimizing your experience.

Dealer and Seller Responsibilities

In the context of clean vehicle credits, both dealers and sellers have critical responsibilities to ensure compliance with regulatory standards and optimize the transfer process for electric vehicle credits. Understanding your obligations will facilitate smoother transactions and proper documentation.

Point-of-Sale Documentation

You must meticulously manage point-of-sale documentation when processing eligible vehicle transactions. This involves accurately completing Time-of-Sale Reports, which detail the sale and transfer of vehicle credits. Each report must include the Identification Number of the vehicle along with specific credit details.

Dealers should register with the Energy Credits Online Registration portal. This platform verifies the seller’s identity and enables real-time confirmations of transactions. Any inaccuracies in the reports can lead to penalties, hence it is crucial to check all entries for correctness before submission. Documentation retention for at least three years is necessary, supporting future audits or inquiries.

Transfer Election and Reporting

When engaging in a Transfer Election, you must ensure that both you and the buyer understand the implications of the credit transfer. This involves clearly communicating whether the credits will be transferred at the point of sale.

Accurate reporting is essential for various Eligible Entities, such as registered dealers. They are responsible for ensuring that the transferred credits comply with federal guidelines. Implementing rigorous internal controls will help in maintaining compliance. All related documentation, including any agreements and confirmations, should be retained to substantiate the transfer and support financial audits. Failure to adhere to these regulations could result in loss of privileges or penalties against your dealership.

Clean Vehicle Credits for Individuals and Businesses

The Clean Vehicle Credits offer significant financial incentives for both individuals and businesses looking to invest in electric vehicles (EVs). Understanding the specifics of these credits can enhance your purchasing decisions and maximize your financial benefits.

Personal Use Vehicles

For individual consumers, the Previously Owned Clean Vehicle Credit is an essential opportunity to incentivize the purchase of used electric vehicles. Under Section 25E, this credit can provide up to $4,000 for qualifying used EVs with a Manufacturer's Suggested Retail Price (MSRP) below $25,000. It's important to note that the vehicle must be at least two years old and sold by a qualified seller.

You can also benefit from the New Clean Vehicle Credit, which allows for a transfer election beginning January 1, 2024. This transfer enables you to assign the credit, up to $7,500, directly to a dealer, reducing your upfront payment. Ensure that you review publications like 5863 and 5864 for comprehensive details on eligibility and paperwork required.

Commercial and Business Use Vehicles

Businesses can take advantage of credits for Qualified Commercial Clean Vehicles to encourage eco-friendly fleet acquisitions. The Clean Vehicle Credits can cover 30% of the basis for electric or fuel cell vehicles. There are also specific stipulations regarding the size and function of these vehicles.

Furthermore, businesses have the option to transfer the commercial clean vehicle credit to streamline costs. Utilizing publications such as 5865 and 5866 can provide deeper insights into compliance and the application process. Brands like Next NRG offer excellent solutions for enhancing the efficiency of commercial fleets with wireless EV charging systems, ensuring your operations remain reliable and cost-effective.

Don’t Miss Out

Join our newsletter to get latest insights for your brand growth!